Token Advice - #7 📈

Market Update | Crypto Regulation | Bitcoin ETF | Cash Flow Management Tips

🔁 Market Recap

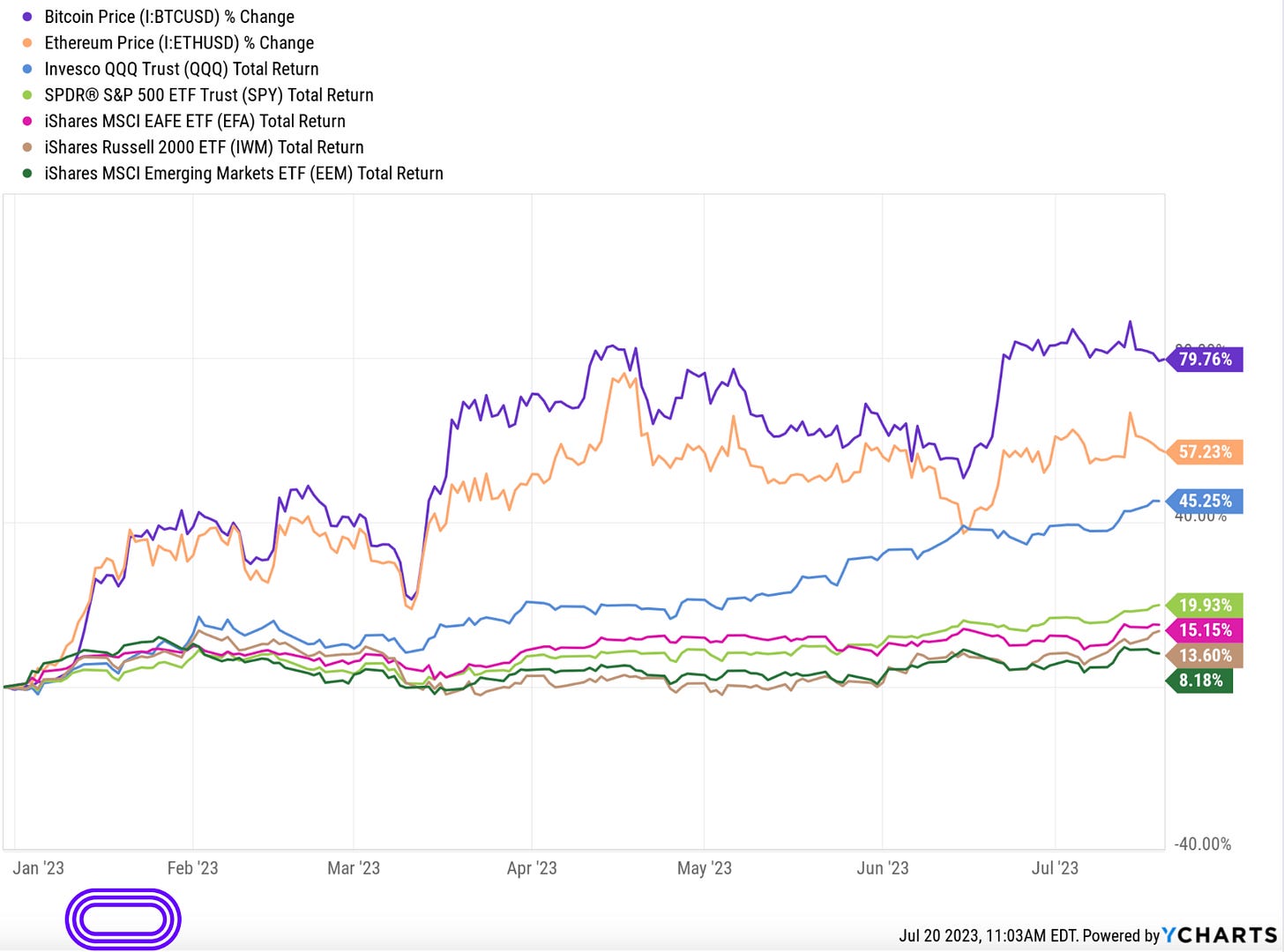

2023 Year-to-Date Returns:

It’s no secret that many investors were highly pessimistic heading into 2023 as they continued to deal with inflation, falling earnings, and fears of recession. Cryptoasset investors had their own set of issues, coming off a tumultuous 2022 full of negative news headlines. Those in the financial media were sounding the alarms across the board. What happened next? The Nasdaq’s best start to the year since 1983. Bitcoin’s best start to the year since 2019. And the S&P 500 sitting just 2% away from fresh all-time highs. It’s important to remember that the markets are:

1. Forward looking

2. Not the economy

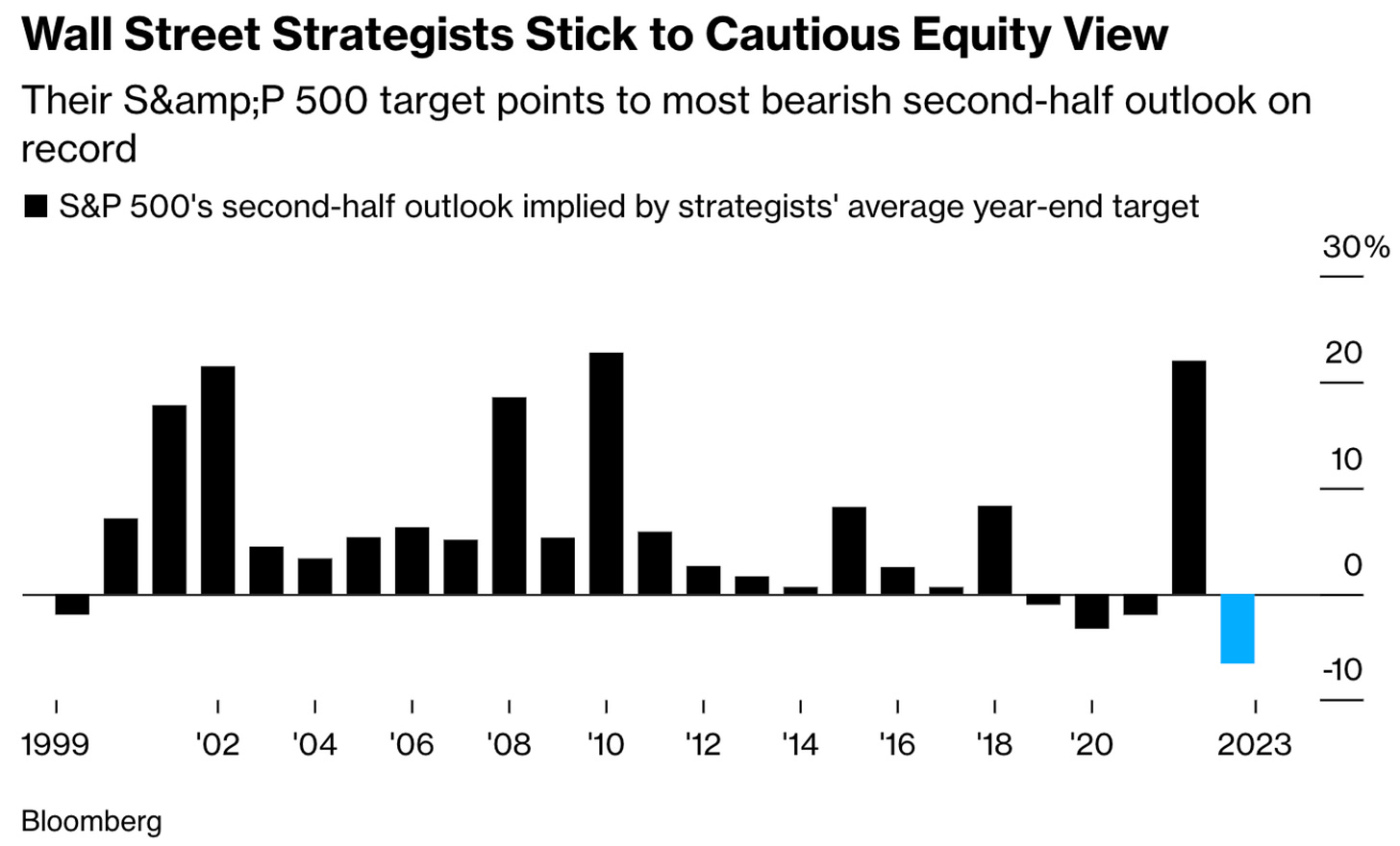

What do investors think for the back half of the year?

Analysts remain bearish. Historically speaking, this isn’t the type of sentiment we would expect to find at market peaks. We’ll see if they’re right.

What we’re watching in crypto:

Ongoing Regulatory Developments

It’s been a busy couple months in the ongoing fight for crypto regulations. In early June, the SEC sued both Coinbase and Binance for what they deemed to be “operating unregistered securities exchanges”. They listed 25 total cryptoassets in the two suits, including well known assets such as Polygon and Solana’s native tokens MATIC and SOL. Many in the cryptoasset space felt this was an overreach of the SEC’s powers, claiming that cryptoassets are multi-functional and don’t meet the Howey Test.

Just last week, crypto natives celebrated a partial win against the SEC, when a judicial court ruled that XRP (Ripple’s native token) is not in and of itself a “contract, transaction, or scheme that embodies the Howey requirements of an investment contract.” The sentiment in crypto is if XRP isn’t deemed a security outright, then hardly any cryptoassets could be. This is likely because it’s well known in crypto circles that Ripple is one of the most “centralized” cryptoassets out there, meaning it has a company working on it and overseeing it. This isn’t the case for many other cryptoassets that are more decentralized in nature and solely run on smart contracts. Ripple was relisted on Coinbase and many “alt” cryptoassets such as Solana rallied on the news.

Our take:

While many find themselves discussing whether or not cryptoassets are securities, we’re not letting that distract us from the ongoing building and activity taking place onchain. Contrary to popular belief, most applications are not a decade old in crypto. They’re only 1-3 years old, and they’re finding product market fit right in front of our eyes with tech savvy users. Our thesis remains that self-custody will ultimately find a way to the masses as the UX improves. People deserve the right to own digital property just as they do physical property.

Monthly active onchain users were at all-time highs in June:

Bitcoin ETF Filings

Blackrock made news headlines last month when it announced it was entering the race to file a spot Bitcoin ETF which would allow investors to “own” BTC through an easy to access investment vehicle. This was a complete 180 from the sentiment Blackrock CEO Larry Fink expressed in 2017 calling Bitcoin an “index of money laundering”. Similar to many traditional finance CEOs over the last few years, Fink changed his tune and now believes crypto will “transcend international currencies due to to global demand”. Strong words coming from the head of the world’s largest asset management firm. It appears Europe will beat the US to the punch, as a new Bitcoin spot ETF will go live in August.

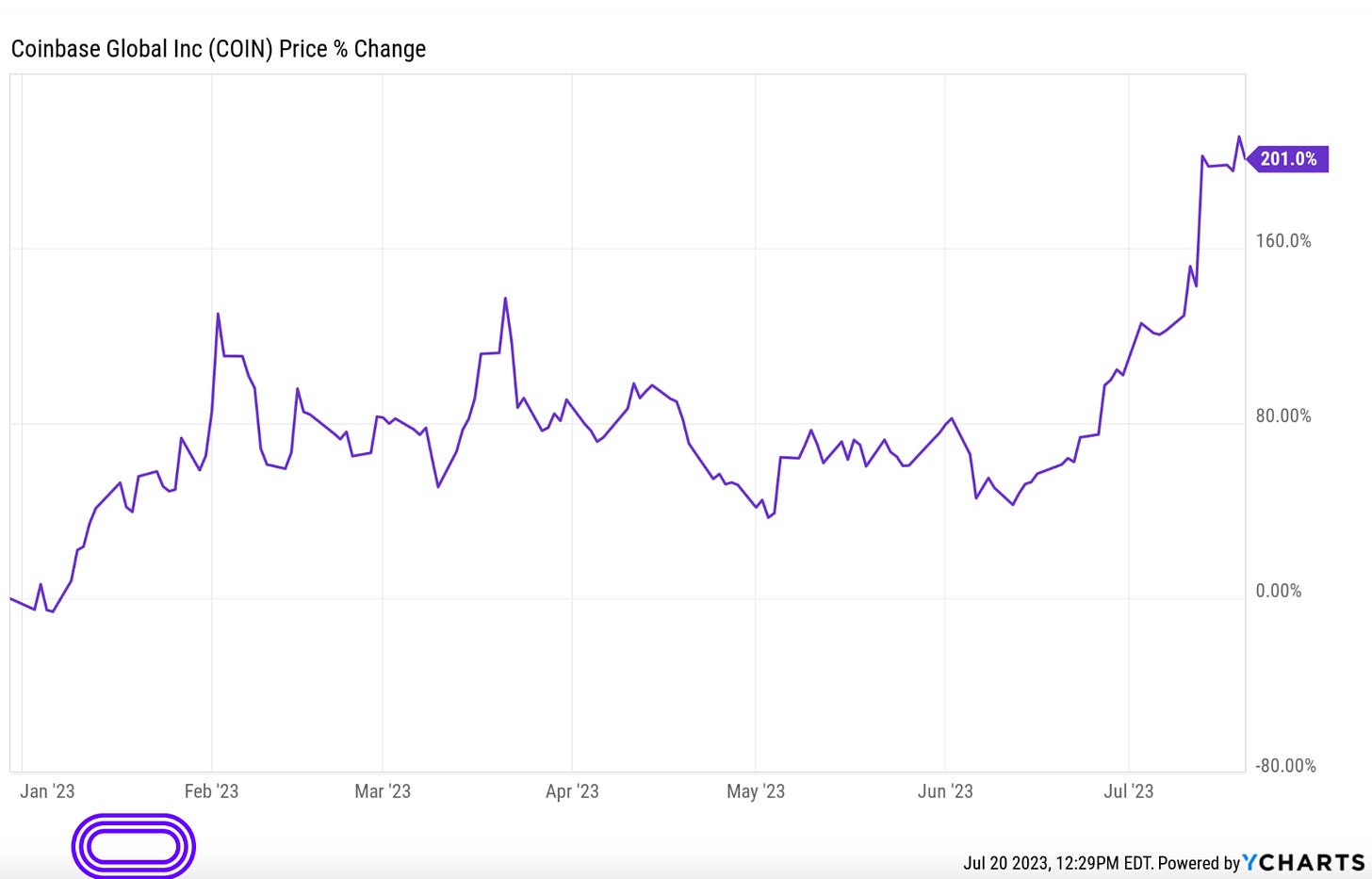

Following Blackrock’s filing, a wave of other asset managers followed suit and filed their own respective spot BTC ETFs. Some of these include: Cboe, WisdomTree, VanEck, Invesco Galaxy, and Ark Invest. Coinbase was listed as the custodian on Blackrock’s filing and was also listed as the surveillance sharing partner on all of the ETF filings. Coinbase’s stock has surged recently on all of the positive developments and is now up over 200% in 2023.

Our take:

At 401 Financial, we’ve been fairly outspoken in our feelings toward a Bitcoin ETF. You can listen to our CEO Tyrone Ross’s latest comments here.

The fact is, many of us who have been crypto advocates for years look at Bitcoin, Ethereum, and other onchain tools as access points to the global financial system. A new, alternative financial system to the traditional one. A financial system where everyone can store value, own their digital assets, and move money freely. In short, we don’t view crypto as only an asset class to invest in. We view it as a tool, one that millions around the world use every day.

Could a spot Bitcoin ETF bring in new capital to the space once approved? Absolutely. Can traditional financial systems and onchain financial systems coexist and operate in tandem? We believe so. All of that said, our goal is to continue to educate people on what the true ethos behind “crypto” is: The ability to own things digitally and access plus participate in the financial system.

Bitcoin’s compounded annual growth rate:

Practical Tips for Improving Cash Flow in Today's Market

Today, we're flipping the script on cash flow management and debt reduction. We're diving headfirst into a simple approach that will elevate the way you handle your finances.

Cash flow—it's the lifeblood of your financial well-being. But let's be honest, it's not the most thrilling topic, right? We've crafted a shortlist of tips to make navigating cash flow management easier.

💡Quick Tips for Improving Cash Flow 💡

1️⃣ Assess Your Expenses: Take a close look at your monthly expenses and identify areas where you can cut back. Challenge yourself to reduce discretionary spending and focus on essential needs. Every dollar saved can contribute to improving your cash flow.

2️⃣ Negotiate Bills and Services: Reach out to your service providers, such as internet or utility companies, and explore the possibility of negotiating lower rates or finding better deals. In today's competitive market, many providers are open to accommodating their customers' needs.

3️⃣ Diversify Your Income: Consider exploring alternative sources of income to supplement your current earnings. This could include freelancing, starting a small business, or even investing in income-generating assets. Diversifying your income can help stabilize your financial situation and increase your cash flow.

4️⃣ Prioritize Debt Repayment: If you have outstanding debts, prioritize their repayment. Focus on paying off high-interest debts first while making minimum payments on others. Consider debt consolidation options to streamline your payments and potentially lower interest rates.

5️⃣ Create an Emergency Fund: In uncertain times, having an emergency fund is crucial. Set aside a portion of your income each month to build a financial safety net. This fund will provide peace of mind and protect you from unexpected expenses that could negatively impact your cash flow.

🔧 Tools for Cash Flow Management 🔧

1️⃣ Zero-Balance Budget: Consider using a "zero-balance budget" tool to manage your cash flow effectively. By allocating every dollar of income each month, you can prioritize debt reduction, savings, and avoid losing track of your spending.

2️⃣ Expense Tracking Apps to take check out:

3️⃣ Debt Consolidation: If you have multiple high-interest debts, you may consider exploring debt consolidation. This can help you combine your debts into a single, manageable payment plan with potentially lower interest rates. DIY debt consolidation through balance transfers can help simplify your repayment process and save you money on interest charges, putting you on the path towards financial freedom.

Remember, managing your cash flow and reducing debt is a journey that requires commitment and consistent effort. By implementing these tips and utilizing the recommended resources, you'll be on your way to achieving your financial goals and creating a more secure future.

401 Financial Cohort

Tune into Crypto Office Hours on Financial Advisor TV